Emerging World Investor - "The World and All That is Shaping It" - Volume I

The Three Collisions Shaping Our World. The Case for Investing in Emerging Markets. Market Spotlight: Saudi Arabia. Whither Russia's Trillions? IMF on King Dollar. Lat-Am Forecast 2023

Emerging World Investor Issue I

Opening Shot: The Three Geopolitical and Geo-Economic Collisions Shaping Our World

Is it Time to Jump Back into Emerging Markets Equities?

Equity Market Spotlight: Saudi Arabia

Whither Russia’s Trillions?

Corporate Spotlight: Etihad Airways

Regional Outlook 2023: Latin America

Dear Friends and Fellow Emerging World Travelers,

Welcome to Emerging World Investor Vol I. - an old-school newsletter with few bells and whistles, no pop-ups, no scrolling ads, and no one asking you some advertiser-driven questions about your coffee-drinking habits or favorite wristwatch brand. It’s just one part of Emerging World publication by me, your humble correspondent and fellow traveler.

We are still free of charge, but thank you for your most valuable currency: your interest. You can always reach me at eworldairmail@gmail.com

I could go on and on and say more about this first issue but….well, you’re busy and swamped with information and analysis and the macro landscape is changing rapidly (even as you read this) so, well, let’s just roll...

Opening Shot - Musings on Mountains, Tectonic Plates, and The Collisions Shaping Our World from Iran to Global Debt

Whenever I look at a mountain, I get that familiar feeling of the sublime, marveling at nature’s creation soaring into a cloud-filled sky. When I think about how mountains are formed, however, I am reminded of the clash of tectonic plates, the violent collisions beneath the earth’s surface that created those sublime natural monuments.

We are witnessing some violent collisions in our macro world today, both literally and figuratively. I’m watching three of these collisions closely because they have the ability to alter the political and commercial geography of our world. Some musings below on these collisions (will write more on each one in subsequent issues)

All three collisions have a familiar theme: an unsustainable status quo meets a restive reality.

The question is: will these collisions create sublime mountains, or smoldering volcanoes?

These are three collisions I’m watching:

The Autocrats Stumbling and Overreaching vs People Rising. Witness Iran, and also on a smaller scale, China.

Asset Inflation vs Price Inflation vs Rising Debt vs Growth vs Inequality (All five plates crunching together at once)

Geopolitical Fractures - China/Russia vs US/Europe - The US-China Deceleration and the End of the Russia-Europe Bargain

I’m going to give a brief rundown of these collisions, and will keep watching them in subsequent issues (and would welcome your views in the comments section, or directly to me at emergingworld85@gmail.com).

Let’s start in Iran. We are witnessing a profound moment as courageous Iranians hungry for dramatic change are risking their lives for freedom. By now, we know the ostensible trigger point: the September beating and death of Mahsa Amini, a young Kurdish woman taken in by “morality police” for her “failure” to adhere to the “Islamic” dress code enforced by the “Islamic Republic” *(lots of quotes in that previous sentence for obvious reasons, starting with the immorality of the so-called morality police..)

Mahsa Amini’s death was, in a way, the final crunching of two tectonic plates violently meeting: a vibrant, dynamic, young population hungry for a normal life in the 21st century meeting head on with a sclerotic, greying, inept, corrupt, and brutal regime that spends far too much time worried about women’s hair and not enough time crafting pragmatic economic and foreign policies that would uplift their nation.

These plates have been heading toward each other for a while. This is not new and should not have caught anyone by surprise. In the late 90s and early 2000s, your humble correspondent and caravan leader of the Emerging World worked as a correspondent in Iran for the Washington Post (among others). I wrote a book, published in 2005 as The Soul of Iran: A Nation’s Journey to Freedom. When I look back on the book and some of my writing from those days, it seems clear to me that the crunching of these plates were inevitable.

A kind soul recently sent me a link to a piece I wrote in the Wilson Quarterly back in 2003. In the piece, I laid out the rot and fragility at the heart of the system in Iran.

“the Islamic Republic fell into the very traps that undid communism: hollow, state-sponsored glorification of a leader (Khomeini); dramatic but abrasive attempts at social engineering to create a ‘vanguard’ of the Islamic Republic (‘Islamicizing’ Iran’s universities, for example, and creating ‘Islamic tests’ for officials); purges of ‘disloyal’ officials; corruption within the nomenklatura; tight control of the media; a sluggish and failing state-dominated economy; and the use of hired street thugs to quash dissent. Eventually, inevitably, Iranians began to grumble. Today, the country is in a state of quiet revolt, punctuated by the occasional loud protest. Iranians are hungry for change. They seethe under the weight of an inert economy, disillusioned by the failed political promises of the revolution (and, more recently, of the country’s reform movement), and frustrated by restrictions on social freedoms, by government corruption, and by the domination of the conservatives and hard-liners.”

Afshin Molavi, Wilson Quarterly, 2003, “The Disenchantment”

Please excuse me, dear reader, I’m not in the habit of quoting myself in these pages, but I do so here only to note that this deep frustration in Iran is not new - as some have suggested - and it cuts deep into society.

Iran’s uprising still has a long way to go. The regime remains brutal. They have already started executing some of the protestors, and are using live fire in Kurdish and Baluch regions. I’ll have more to say on this in later posts, but the key point here is this: if the uprising is successful, it could alter the political and economic geography of the Middle East and North Africa and beyond. For more on this theme, read the always astute Karim Sadjadpour’s piece in the Washington Post linked below

For the purposes of this site, it’s important to note that Iran possesses the world’s second largest natural gas reserves, the fourth largest oil reserves, rich mineral deposits, a culture of entrepreneurship and a highly educated population. It should be a dynamic G20 economy, rather than a failing and flailing one. A pragmatic Iranian government could unleash a West Asian economic tiger. It’s the emerging market that everyone is waiting for with a talented population and a wealthy diaspora eager to invest. A successful uprising in Iran would also have broad ripple effects across the region, while draining away the economic lifeline they provide to the likes of Hezbollah in Lebanon and the Maduro government in Venezuela.

The Islamic Republic’s autocrats have overreached once again, and this time, the backlash represents the most serious threat to their rule.

Now, on to China, briefly. President Xi Jinping has been overreaching for quite some time. While I’ve often noted that the story of contemporary China’s rise from a poverty-stricken nation in the early 1980s to the second most powerful economy in the world represents the most dramatic geo-economic transformation in history, President Xi seems determined to kick a few own goals to slow the China train down. From politically-driven corruption trials to a steady assault on China’s consumer tech sector to his disastrous Zero-Covid policy, President Xi seems to keep shooting himself and his country in the foot.

Eventually, Chinese citizens took to the streets in a rare moment of protest against China’s heavy lockdowns, even targeting Xi in protest slogans. Whether as a result of the protests or not, China has announced an easing of Covid restrictions. This may calm things for a while, but Chinese leaders need to understand that their economic opening in the late 70s and early 80s helped create one of the largest middle classes in the world. Middle classes - even if they are not eventually agitating for political freedom - expect a sense of normalcy and stability.

China’s Communist Party’s bargain with its people is essentially this: we’ll give you consumerism and economic growth and stability, and don’t ask for pluralism or democracy or freedom. Oh, and don’t agitate if we do draconian lockdowns. But what happens when the economic growth train slows, as it has been slowing these past two years?

Amid China’s slowing growth, the Chinese people are also choosing not to have children. Last year, we witnessed the slowest population growth in China since 1960 - which, by the way, was a pretty awful year in China as famine raged across the country. While a smaller population may be helpful in the long run, there are still more millennials in China than there are people in the United States. That’s a large, potentially restive population. The tectonic plates are moving.

While we will continue watching this “Autocrats Overreaching vs the People Rising” theme, we should also watch the second collision closely below due to its global ramifications.

Asset Inflation vs Price Inflation vs Rising Debt vs Growth vs Inequality

We are watching multiple tectonic plates colliding. We are witnessing the unwinding of low interest rate-fueled asset inflation as the central bankers across the world now go to battle against real inflation. At one point this year, the S&P 500 was down about $11 trillion in market value. The aim of central bank monetary tightening is to slow aggregate demand to cool economies. This will induce recessions (mild ones, if you please. the central bankers are hoping). The IMF says about 1/3 of world economy and half of the EU will experience recession in 2023.

Now, what about the massive debt tectonic plate heading toward us? Recessions are generally not good for servicing debt - especially if that debt is in surging dollars.

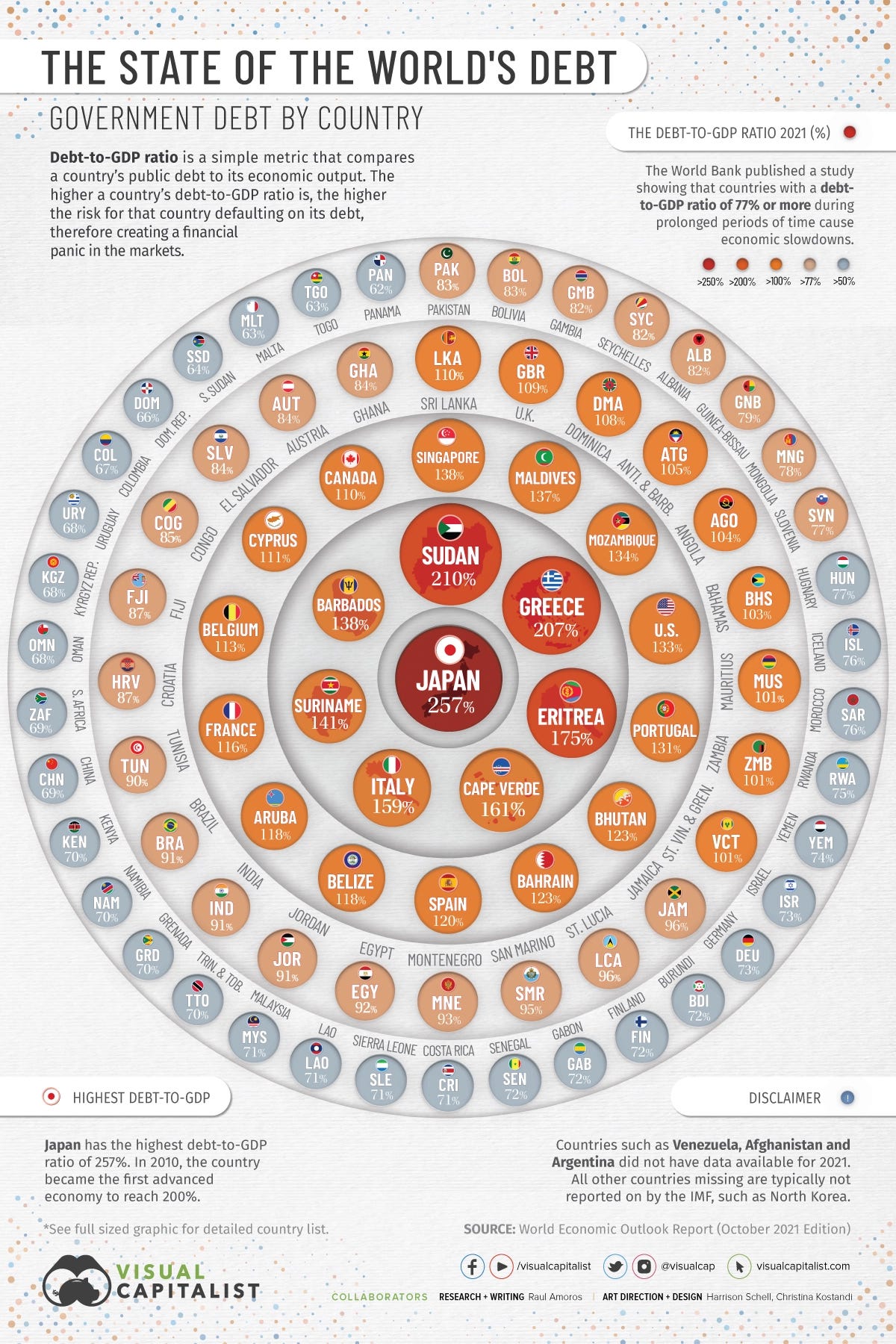

Global debt worldwide now exceeds $300 trillion - more than 3x the size of the global economy. Check out this chart from Visual Capitalist below

That circle above is a spinning tectonic plate that will spawn implosions and explosions across the world.

Now, layer on top of this the growing inequalities across the world and within countries - laid even more bare by the Covid pandemic (think of the lost schooling for children with poor broadband access or no parent or guardian to help them navigate a ‘virtual’ school day, to cite just one example). I’ll have more to say on this and would love to hear from you (eworldairmail@gmail.com or comments below), but we must move on to…

Geopolitical Fractures - China/Russia vs US/Europe

What about the geopolitical bomb that Putin set off when he attacked Ukraine? I wrote about that in these pages - Putin’s Bomb and the Global Shrapnel. By attacking Ukraine, Putin has put in danger a multi-trillion dollar well-oiled energy sales machine to one of the most reliable customers in the world: Europe (for more on that, see below). He has also left the Russia-Europe post Cold War bargain of economic integration in tatters. It was a dramatic own goal with dramatic humanitarian ramifications.

The war also drew some sharp geopolitical lines in the sand between “the West” and “the rest” to put it broadly. While the G-7 powers, Europe, and the United States are largely united in their attempts to support Ukraine and isolate Russia, the rest of the world has demonstrated little appetite for choosing sides.

It has also been a dizzyingly rapid fall from grace for Putin who once strode the world stage with relative ease, meeting world leaders, back-slapping with the likes of Chancellor Angela Merkel and George W. Bush, and even hosting the World Cup in 2018 - even after Russia’s annexation of Crimea.

Enter China in the mix. The United States, Europe, the G-7 and the “West” were already decelerating their economic and political ties with China. The key word here, though, is decelerating, not de-coupling. The ties that bind China and the United States — including a $500 billion+ - trade relationship cannot be de-coupled overnight, nor the ties that bind China and the EU on trade or investment. What we are likely to see is general slowing, decelerating, in these ties. They will still be consequential, but the growth chart will be much bumpier.

That is, unless Xi overreaches and moves on Taiwan. Then, the tectonic plates would move dramatically closer to collision, and the charts would implode fast.

Ok, enough on collisions and geopolitics, and on to a question many are asking:

Is it Time to Jump Back Into Emerging Markets Equities?

Readers of these pages know that I’m generally bullish on three key trends driving the emerging world: rapid urbanization, unprecedented connectivity, and growing middle classes. These trends have been constants over the past two decades, and still have room to grow. The implications are vast, encompassing geopolitics, geo-economics, political and social stability and more.

Readers of these pages also know that the so-called “emerging markets” are a large universe of countries and markets that should not be lumped into a single class. There is far too much differentiation across markets. While China stocks have been hit hard the past year, Indian equities have been on a roll, to cite just one example.

And, yet, the investing universe - particularly the ETF universe - still often treats emerging markets as one.

There’s no clear consensus on Wall Street on the EM outlook for 2023. In fact, the FT reported that “Wall Street’s biggest banks are split on the outlook for emerging market equities, with Morgan Stanley and Goldman Sachs taking diametrically opposed views after a punishing $2tn sell-off this year.” In short, Morgan Stanley is bullish; Goldman is not quite bearish, but wary.

So, let’s take a look at the top ten stocks in the MSCI Emerging Markets Index. Over the past few days, there has been some impressive pops in prices - admittedly after a heavy beating throughout the year.

Is this the early sign of sentiment shifting, or a temporary correction after a beat-down?

The MSCI Index Top Ten are ranked below by their weighting in the MSCI Index as of Nov 30, 2022.

Taiwan Semiconductor MFG (6.13%)

Tencent Holdings Li (CN) - (3.61%)

Samsung Electronics Co - (3.53%)

Alibaba Grp Hlding (HK) - (2.44%)

Reliance Industries - (1.60%)

Meituan B - (1.45%)

Infosys - (1.06%)

Vale On - (1.02%)

JD.com (HK) - (.95%)

ICICI Bank - (.94%)

Sentiment has also shifted within Emerging Market ETFs. The top performing country indexes for November include China, Hong Kong, Taiwan, and South Korea - all 2022 underperformers.

EM ETF Watch

The top performing country ETFs in Emerging Markets - via Seeking Alpha

Monthly performance (November) - with links to charts on Seeking Alpha

China - GXC - +25.07%

Taiwan - EWT - +21.97%

Turkey - TUR - +21.86% »»»»»»»»»»»»»»»»»»» Year to Date: +80.98% (Top Performer)

Hong Kong - EWH - +20.92%

South Korea EWY - +14.88%

These are obviously just snapshots in time. For a deeper dive, check out a piece written by David Dali, head of portfolio strategy at Mathews Asia. He recently made a compelling case for investing in EM today

The Bullish Case: Matthews Asia

Some excerpts below:

Five Reasons Why Emerging Markets Are Investable Today

“Looking back 20 years (or 80 quarters), there have only been five end-of-quarter instances when the MSCI Emerging Markets Equity Index has registered a price-to-earnings (P/E) multiple of 10 times or less. The September quarter-end was one of them, with a P/E of 9.96 times. Of the prior four instances, the median index total return for the subsequent one year was 19.03% and for the subsequent two years it was 31.47%. And in all the prior cases, the five-year total returns were positive. We believe this pattern bodes well for the point in the cycle we are at today.”

“Experienced investors generally accept that emerging markets are often less predictable and more volatile than some other equity asset classes, such as European and North American stocks. Over the past 30 years, there have been many instances when emerging market equities have fallen more than 15%. But it’s less common for emerging markets to fall over 30% in 18 months and even more infrequent for a major market, like China, to fall over 50% in that period. That’s exactly what has happened since May 2021.”

While innovative sectors like IT and health care have been primary drivers of emerging market returns over many years, we believe the theme is just getting started. In simplistic terms, we view Asia and China innovation today as roughly equating to the U.S. innovation period of the late 1980s and ’90s, when Microsoft, Genentech, Apple and Nike, and Google, Amazon and Facebook respectively were laying down their foundations. Asia and China’s current stage of development, buying power and consumer preferences, point to a similar path of demand for innovation. We believe innovation should be a core growth theme within an emerging markets allocation and our innovation strategy puts this into practice.

For the full David Dali piece from Mathews Asia piece, go here.

Saudi Arabia Equities Spotlight

While much attention is paid to China given its heavy weighting in the index, it’s important to remember that the MSCI EM index and the broader universe of equities is far more than China or the top ten holdings. One of the more recent MSCI entrants is Saudi Arabia.

A friend of Emerging World, Malcolm Dorson of Mirae Asset Management, recently visited Saudi Arabia and delivered an insightful report on the prospects for investing in Saudi equities. Some excerpts below:

“We walked away impressed with the country’s surprisingly prudent fiscal policies (Saudi’s fiscal breakeven oil price has come down from over $106 to $69 a barrel) and commitment to market improvements. Despite being the largest equity market in the Eastern Europe, Middle East, and Africa region (36% of the MSCI EEMEA index2 ) and the 6th largest market in the emerging markets (EM), 64% of global equity investors still do not hold a single name in Saudi Arabia.3 Though we find it prudent to remain neutral from a country perspective, we see a significant amount of overlooked individual companies in the market that we believe can compound earnings above their cost of capital for years to come.”

I reached out to Malcolm and asked him to share some ideas on Saudi equities with us at Emerging World. Here’s his take

Jahez: Food delivery

•Competitive advantage: Unlike peers in other countries, Jahez is already profitable despite being the #2 player (after Delivery Hero). Jahez also benefits from its customers typically spending more versus competitors.

•Structural: Food delivery penetration in KSA is almost half that (~18%) vs that of nearby GCC countries as well as in the US/UK (~30%), despite higher mobile phone penetration. The young, mobile savvy population, is also undergoing tremendous social change, and includes changes such as women joining the labor force.

•Growth: Jahez also has room to increase take rates as the company is charging lower rates (~12%) versus peers in the country. Management plans to grow both regionally and via product, as it has the capability to become a full 3P e-commerce logistics platform.

He also likes Tadawul: Saudi Exchange

Here’s why:

•Quality: From an internal perspective, the company is a net cash, asset light, monopoly with significant operating leverage and various growth channels (derivatives, fixed income, M&A).

•Structural: From a structural perspective, it should serve as a key beneficiary from Saudi’s robust IPO pipeline, less draconian requirements for international investors to invest in KSA, very low penetration in fixed income & derivative investing, and a longer term shift to more individuals actively investing their savings. On a macro level, Saudi is one of the few countries in EM with a US dollar peg, meaning minimal currency volatility.

•Growth: Catalysts come in the form of IPOs, new product introductions, and a potential fee renegotiation with the CMA. Medium/Long term catalysts come in the form of market maturation.

Finally, he likes two banks - SNB and Al-Rajhi. For more on those picks, you can always reach us at eworldairmail@gmail.com

For those interested, here are some resources to follow Saudi Equities

Riyad Capital Daily Stock Market reports

KAMCO MENA Markets Report (Daily)

The iShares MSCI Saudi Arabia ETF KSA is down 8.97% year to date, but had a stellar 33.7% total return in 2021.

For more on KSA ETF, including its five year returns and top holdings, see Blackrock or Seeking Alpha.

Whither Russia’s Trillions?

Remember that massive own goal by Putin that I wrote about earlier?

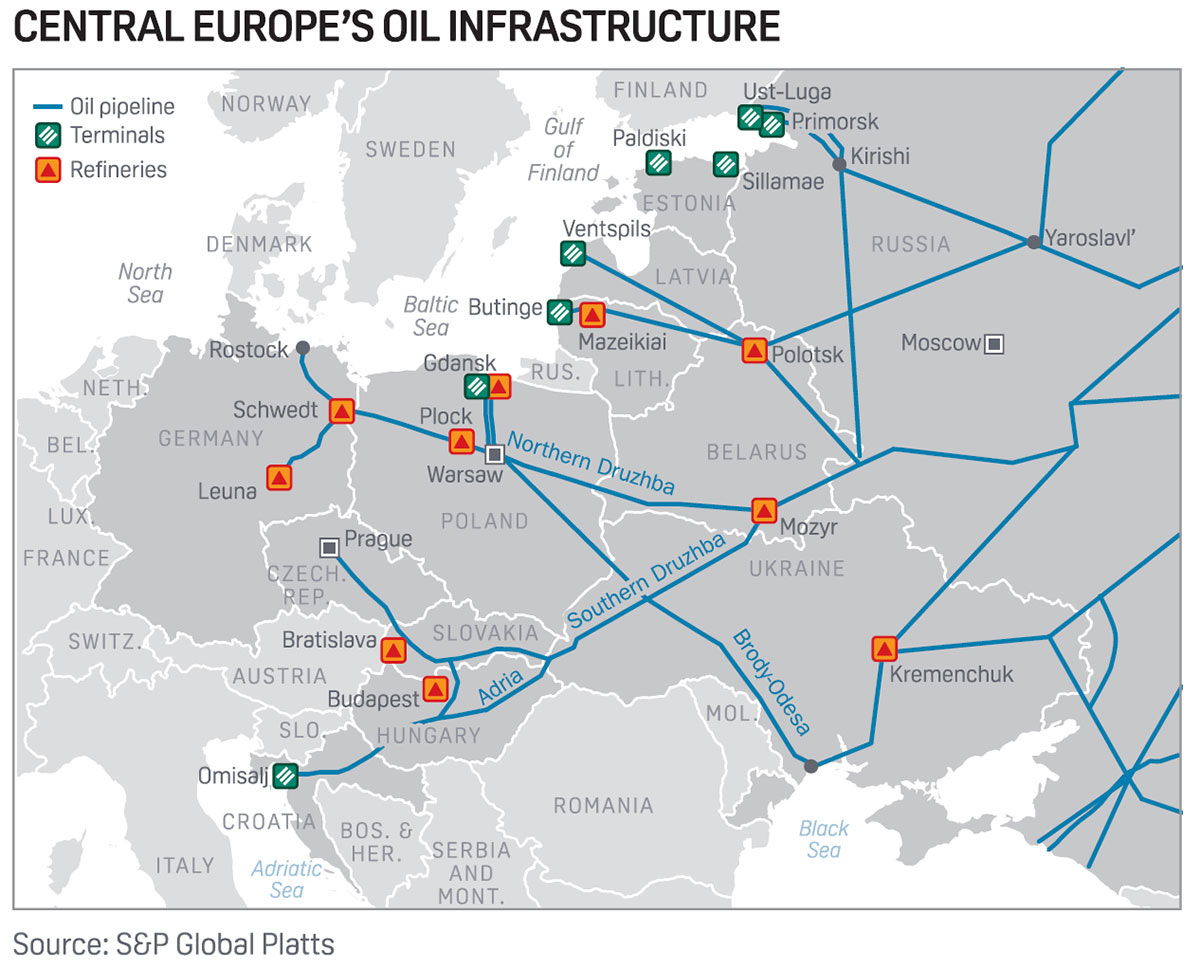

On December 5, a European Union ban on all seaborne crude shipments from Russia came into effect - to go along with a G-7 led price cap on Russia oil that would prohibit European insurers and tankers from doing business with Russian companies unless the oil price sold stays below a $60 threshold. Both of these developments will further inhibit Russian oil sales over the long-run, reducing a country that was once an energy superpower into a flailing, sanctions-evading, energy giant punching far below its weight.

Yes, I know, Russia continues to sell more oil to Asia and has benefited from higher prices in 2022, but that’s the calm before the storm. The spider web of sanctions and strictures will eventually wear it down. Think gradual decline, not economic implosion, but decline it will.

Now, the only legal Russian oil that can flow to the EU will be via the Dzhruba pipeline to Central Europe (Bulgaria also has a carve-out and can still import seaborne crude through 2024).

So, what’s the bottom line for Russia? They are shooting themselves in the foot — and the leg and entire body. Before Putin moved on Ukraine, Russia had developed a sophisticated network of oil and gas pipelines and seaborne shipments to one of the most reliable markets in the world: Europe. It was a well-oiled, cash-generating machine in the trillions of dollars over a decade and a half. Yes, trillions. Russia blew up that prize, and though it has benefited from high oil prices and increased sales in Asia in 2022, Europe will no longer be a major market for its oil and natural gas.

Take a look at the chart below and do the math. From 2006-2021, the EU and the UK paid Russia more than $2.25 trillion in energy imports.

Yes, trillion. It’s also worth noting from this chart that the blue line - crude oil - has been the dominant revenue earner for Russia. Yes, Russian natural gas has been vital to European industry and daily life, but oil sales have been a bigger part of the bottom line for Moscow. That $2.25 trillion dollar prize is crumbling.

So, while some will point out that Russia exported 7.7 million barrels per day in October - a robust figure - the direction is clear: Russia’s days as an energy superpower are over, as Daniel Yergin has noted.

So, what’s it like you are marketing Russian crude these days? More often than not, you are providing discounts to buyers while your tankers are hiding cargoes or engaging in illicit ship-to-ship transfers. Murky players willing to bend the rules are likely making a killing. Seaborne flows have also shifted largely away from Europe and more towards India and China and, to some degree, Turkey.

Still, this is a far cry from the $2.25 trillion cash-generating machine of Russian energy sales over the past decade and a half, a time when the world’s major energy companies flocked to Russia to jointly invest and extract more oil and gas for world markets. Those days are gone as the war creaks on.

Notable Quotable - Russia/Ukraine Peace “Not There Now” - NATO Chief

“The conditions [for talks] are not there now because Russia has shown no sign of engaging in negotiations which are respecting the sovereignty and the territorial integrity of Ukraine. It is for Ukrainians to decide when the time is right to start to negotiate and to agree the conditions. Most wars and most likely also this war will end at the negotiating table.” - Jens Stoltenberg, NATO Secretary General speaking to the FT Global Boardroom

Emerging World Corporate Spotlight

In this section, we’ll follow EM companies making waves. The first is Etihad Airways.

Etihad Airways Wins Multiple Global Aviation Awards for Most Sustainable Airline in 2022.

Last summer, AirlineRatings named Etihad Airways the Environmental Airline of the Year for 2022, citing “its clear leadership in the push for sustainable flight.”

Airlineratings.com is a highly regarded service that ranks airlines on a wide variety of metrics, from best airline of the year (Qatar Airways in 2022) to best air cargo (Korean Air) to best first class (Singapore Airlines), to best value (VietJet) and more. See all ratings here.

This year, they inaugurated an environmental airline of the year award, granting the distinction to Etihad. Editor-in-Chief Geoffrey Thomas pointed to Etihad’s Greenliner Boeing 787 program and its Sustainability50, A350 aircraft, as key initiatives driving Etihad’s sustainability focus.

“At every touchpoint, Etihad Airways staff and management are committed to reducing the airline’s CO2 footprint and it shows,” Thomas said.

SimpleFlying, the aviation website, offers more background on Etihad’s sustainability initiatives.

“Etihad Airways was the first airline in the Middle East to announce it would target net-zero CO2 emissions by 2050. In order to identify and test sustainable technologies to help it on the way, Etihad has its Greenliner program.”

“In November 2019, Etihad Airways launched the Greenliner program in collaboration with Boeing and General Electric. It is the umbrella under which all Etihad sustainability initiatives fall.”

CNN Travel reported on Etihad’s Greenliner last month:

“While some delegates at last week's COP27 climate conference were criticized for arriving by private jet, others arrived in Egypt aboard flights that were described as being emission-free, as they were powered fully by sustainable aviation fuel.”

“The flights were part of a program called ‘Greenliner,’ run by Etihad Airways, the national carrier of the United Arab Emirates, as a testbed for sustainable air travel solutions.”

“…the industry is not on track to meet its net zero target by 2050, and is banking on two thirds of that transition coming from sustainable aviation fuel (SAF). It's made from waste products and can curb emissions by 80% on average — but it currently accounts for just 1% of global jet fuel usage. Something needs to change, fast.”

That's why SAF is one of the key elements of the ‘Greenliner’ program. ‘It's essentially a call to action,’ says Mariam AlQubaisi, head of sustainability at Etihad. ‘The idea came about in late 2019 to launch a message to the industry: let's try everything possible to decarbonize.’

Meanwhile, the specialty publication Airlines Routes and Ground Services reports that Etihad Airways just won two more prestigious sustainability awards.

They write:

“Etihad Airways, the national airline of the UAE, has won ‘Environmental Sustainability Innovation of the Year’ award at CAPA’s annual Environmental Sustainability Awards for Excellence in Singapore, as well as ‘Best Airline for Sustainability 2022’ award by Business Traveler USA.”

“The airline quickly went on to unite industry leaders and build a comprehensive, cross organisational aviation sustainability programme that supports decarbonisation, biodiversity protection and waste management.”

For a deeper dive into Etihad’s sustainability initiatives, check out their own site that lays it out in detail.

King Dollar

How do we solve a problem like the strong dollar?

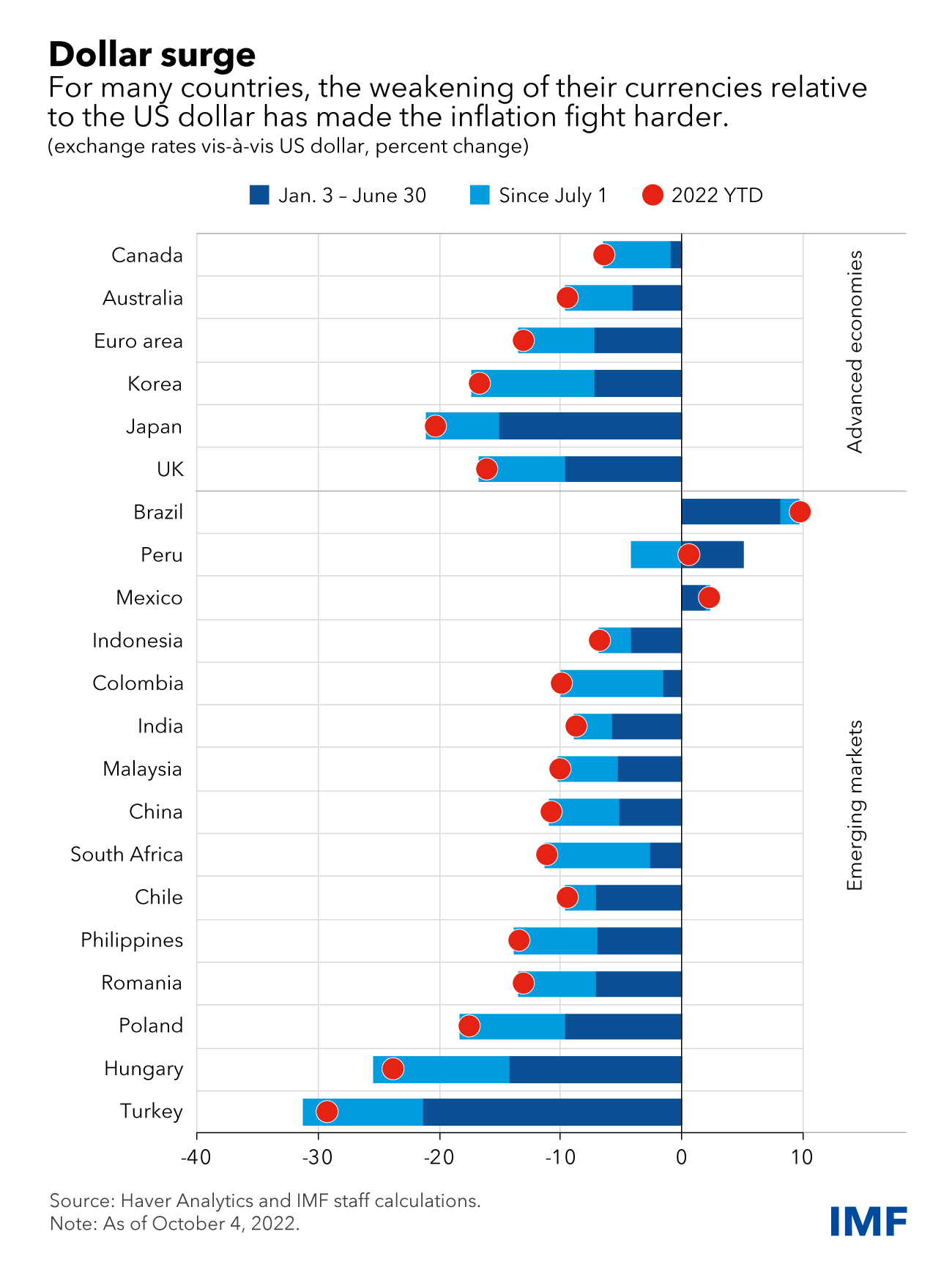

The IMF’s top two economists, Gita Gopinath and Pierre- Olivier Gourinchas grapple with this question in this important blog post over at the IMF site.

Check out the chart below:

“The dollar is at its highest level since 2000, having appreciated 22 percent against the yen, 13 percent against the Euro and 6 percent against emerging market currencies since the start of this year. Such a sharp strengthening of the dollar in a matter of months has sizable macroeconomic implications for almost all countries, given the dominance of the dollar in international trade and finance.”

Johns Hopkins SAIS Schedule of Events and New North Africa Initiative

I’m fortunate to have access to some of the best policy thinking in the world just outside my office door - at Johns Hopkins University School of Advanced International Studies, where I’m a senior fellow at the Foreign Policy Institute. Many of our events are online, and many are public. Check out the schedule of upcoming events here.

I’ll also feature more from Johns Hopkins SAIS scholars in future issues.

In the meantime, my colleague Hafed Ghwell just launched an important new North Africa Initiative.

I’m also pleased to be on the Advisory Council of the Economics and Energy Program at the Middle East Institute led by the always insightful Karen Young. Check them out too.

And.. if you are an undergrad student or mid-career professional reading this and you are interested in an advanced degree in international affairs, SAIS should be your first port of call….

Semafor Africa Summit in DC

If you are in DC on December 12, you should also check out Semafor’s upcoming Africa summit led by the great Yinka Adegoke.

I’m hoping to spot my good friend and long-tme fellow traveler and Editor-At-Large Steve Clemons there.

If you can’t be there, subscribe to Semafor Africa. They are off to a rocking start.

Photo of the Month: Morocco becomes the first Arab nation to enter the Elite Eight of the World Cup.

Must-Reads - Harkster and Al-Monitor Pro

If you’re looking to read one Substack on global investing, then the Morning Hark should be your first choice. It’s incredibly sharp and its site and app provide a great dashboard of aggregated content. It lives up to its tagline - “knowledge without the noise.” I’m honored that Emerging World is featured in their geopolitics, emerging markets and macro sections.

I’ve also become a subscriber recently of Al-Monitor Pro and occasional contributor to their pages (more on that later). New CEO Greg Cohen and my friend and long-time fellow traveler President Andrew Parasiliti are creating an important platform for anyone interested in the business, industry, and economics of the Middle East and North Africa region.

Also, while I’m on the topic, shout-out and kudos to Al-Monitor for their recent hire of Joyce Karam as senior news editor - a top notch journalist and top notch human being.

Latin America - A Rough Year Ahead

Fitch recently put out its Latin America Trends forecast for 2023. Here are their top trends to watch for the year:

“Growth in Latin America will slow sharply, underperforming other EM regions”

“Latin America’s central banks to lead the world into rate cutting cycle”

“Leftist leaders will face growing policy constraints”

“Political risks to continue driving relative currency underperformance”

“Venezuela coming in from the cold, but unlikely to see an economic boom”

An excerpt below:

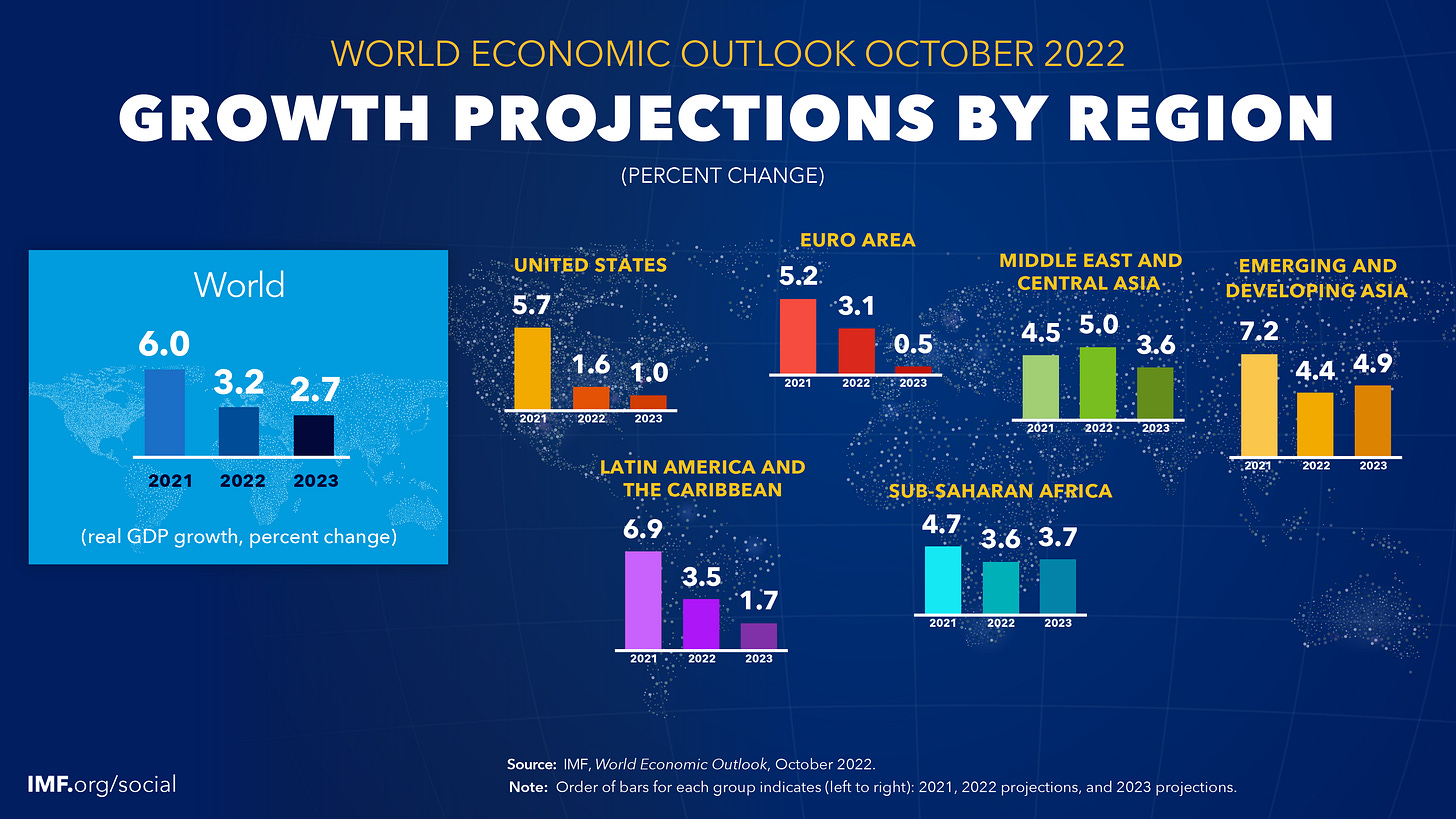

Theme 1: Growth In Latin America Will Slow Sharply, Underperforming Other EM Regions We expect real GDP growth will slow significantly in Latin America in 2023, cooling from an estimated 3.4% in 2022 to 1.2% in 2023. This will make the region one of the weakest performers among emerging markets (EMs), well behind overall EM growth of 4.0% and slower than every other EM region with the exception of Emerging Europe (which will be dragged down by Russia and Ukraine).

Fitch is a premium subscriber-only product, but they put some of their content on their public-facing site here

The IMF growth forecast for Latin America and the Caribbean for 2023 clocks in at a tepid 1.7%, significantly lower than other emerging world regions.

For more on Latin America equities, my friends over at Citywire have a very useful table of top fund managers and funds focused on Lat-Am. Check it out:

CityWire Latin America Equities Fund Managers

Emerging World on the Road…

I’m glad to see the conference circuit heating up again. I was delighted to speak on global macro trends this past year at events from San Antonio, Texas (pictured above) and Palm Beach, Florida to Venice, Italy and Madrid, Spain - and more. I’m looking forward to hitting the road some more in 2023. I always learn so much in those concentrated periods of ‘conference-ing.’ You can always reach me on eworldairmail@gmail.com

And finally, more on sustainable businesses. Friends of Emerging World: Ziba Foods brings Afghanistan’s finest nuts and dried fruits to the world

If you’re looking for a holiday gift that’s different this year, check out our friends over at Ziba Foods. All of their nuts and dried fruits are sourced from Afghanistan. They aim “to bring delicious, nutrient-dense snacks to the world while aiding our mission to implement an ethical supply chain and return Afghanistan to its position as a world-renowned producer of dried fruits and nuts.”

Check them out at Ziba Foods

*Please note: all shout-outs and spotlights are editorially-driven. If they are advertising, they will be introduced as such.

“The Contest is Now” - Epictetus

As always, we like to end our posts with a quote. We usually look for quotes with meaning or uplift. A deep soul sent us this one from Epictetus recently and it landed immediately. I almost felt like he was actually scolding me personally (I need a bit of scolding like this to jolt me, at times).

“Resolve to live as a grown-up who is making progress, and make whatever you think best a law that you never set aside. And whenever you encounter anything that is difficult or pleasurable, or highly or lowly regarded, remember that the contest is now: you are at the Olympic Games, you cannot wait any longer, and that your progress is wrecked or preserved by a single day and a single event. That is how Socrates fulfilled himself by attending to nothing except reason in everything he encountered. And you, although you are not yet a Socrates, should live as someone who at least wants to be a Socrates.” - Epictetus