Vital Suez Trade Route Threatened by Houthi Red Sea Attacks

Vital global trade chokepoint accounts for 12% of global trade and 30% of world container ships. US destroyer shoots down Houthi drones. One of the ships under attack likely owned by China's COSCO.

Amid fears of a wider conflict in the Middle East arising from the Israel-Hamas war, the Red Sea emerged as a major flashpoint this past week as Yemen-based Houthi militants have stepped up attacks on ships transiting through the Suez Canal, one of the world’s major trade arteries.

On Sunday, a US warship and three commercial vessels faced an attack in the Red Sea, the Pentagon reported. The USS Carney, a destroyer, shot down drones and missiles fired from Yemen over the past few weeks, and faced shipper distress calls on Sunday that put it in the line of fire again, shooting down drones headed its way. CENTCOM said it was unclear if the USS Carney was the target of the attack.

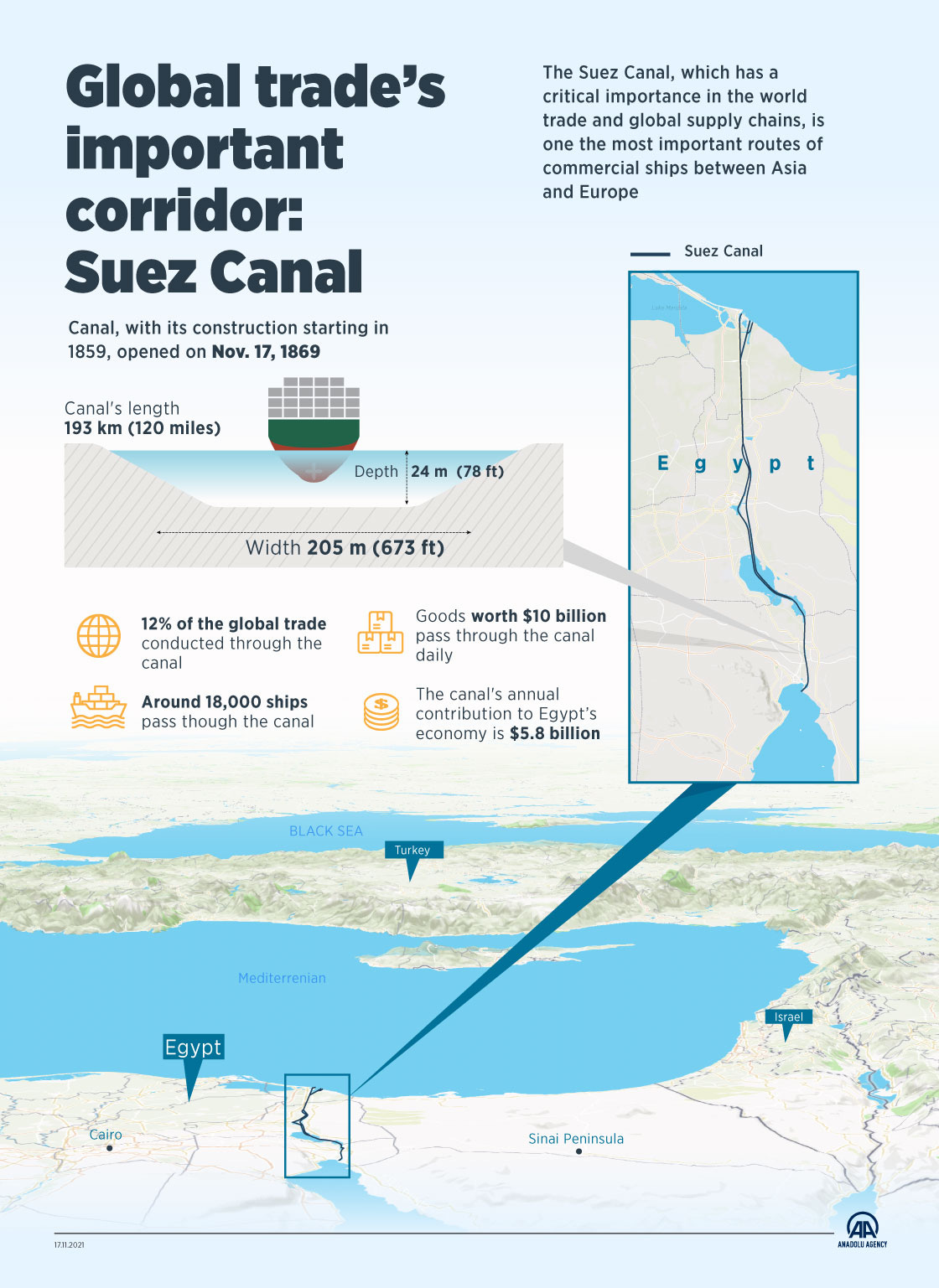

The Houthi attacks have significant ramifications for global trade and the world economy as the Suez Canal accounts for some 12% of global trade, 30% of world container traffic, and $1 trillion of goods per year. The Suez Canal also sees some 7-10% of the world’s oil and 8% of the liquid natural gas (LNG) trade pass through its shores. As the shortest route between most of East Asia and Europe and the link between the Mediterranean Sea and the Indian Ocean, the Suez Canal is vital to the global economy.

As we recall, the obstruction of the Suez Canal for six days by the the Ever Given in March 2021 resulted in substantial disruptions to worldwide trade, with some estimates suggesting that losses amounted to $10 billion per day.

While the Houthi attacks do not represent the same acute danger, uncertainty will lead to higher insurance rates and tough decisions by shippers as to whether to avoid the Red Sea-Suez route in favor of longer ones.

Here’s what we know happened thus far, from a collection of shipping publications and CENTCOM.

From CENTCOM:

Dec. 3, 2023

Release Number 20231203-01

FOR IMMEDIATE RELEASE

SOUTHERN RED SEA — Today, there were four attacks against three separate commercial vessels operating in international waters in the southern Red Sea. These three vessels are connected to 14 separate nations. The Arleigh-Burke Class destroyer USS CARNEY responded to the distress calls from the ships and provided assistance.

…..These attacks represent a direct threat to international commerce and maritime security. They have jeopardized the lives of international crews representing multiple countries around the world. We also have every reason to believe that these attacks, while launched by the Houthis in Yemen, are fully enabled by Iran. The United States will consider all appropriate responses in full coordination with its international allies and partners.

Houthi militants, backed by Iran, have openly declared their intent to strike at ships with Israeli ownership or links. Last month, Yemen's Houthi rebels commandeered a cargo ship linked to Israel in the in Red Sea, taking 25 crew members hostage, according to officials. Often, however, the opaque nature of ship or cargo ownership makes it difficult to assess “nationality” to a ship. Of the three ships targeted on Sunday, only one has apparent Israel links.

Still, as Lloyd’s reported: “Israel-linked ships have reportedly been switching off their Automatic Identification System transponders in the Red Sea.”

Lloyd’s also reported further on ship ownership, noting that one of the ships attacked may be owned by China’s state-owned shipping behemoth, COSCO. If that is indeed the case, China will likely convey a message of warning to Iran to rein in Houthi attacks - or at least ensure they are more precise. The vast majority of Iran’s oil exports are purchased by China and Beijing brokered the Saudi-Iran rapprochement announced in March of this year. Clearly, Tehran will not want to ruffle Beijing’s feathers.

As Lloyd’s reported:

Number 9 is chartered by OOCL, operating on the Ocean Alliance’s Phoenician Express (BEX2) service, according to the CMA CGM’s website. It is managed by Bernhard Schulte Shipmanagement (BSM).

OOCL stands for Overseas Orient Container Line and operates under parent company, COSCO of China.

Shipping publication Splash247 reports that the Houthis may have mistaken the ownership of the Number 9 vessel. Splash247 writes:

In recent weeks, the Houthis from Yemen, as well as Iranians and Somalis, have started to attack Israeli-linked vessels in the Red and Arabian Seas with one car carrier and its 25 crew hijacked and taken to Yemen and a host of others targeted.

Over the weekend, however, the assailants went off script, attacking ships with seemingly no links to Israel, a nation that has been locked in a violent war with Hamas since October 7.

Likely making the most headlines from the barrage of attacks over the past 36 hours was the targeting of the 4,250 teu Number 9, a Panama-flagged ship operated by Overseas Orient Container Line (OOCL), whose parent is China’s state-controlled maritime behemoth, COSCO. The 2007-built ship was struck by a drone 63 miles northwest of Hodeida, Yemen, and took on water. Houthi forces then threatened a second strike on the ship unless it altered course towards the coast of Yemen. The captain replied that the course alteration was impossible as the engine was out of order. The ship had been on a voyage from Singapore to Europe at the time of the attack.

“From a container shipping perspective this is quite a ramp-up in the threat assessment when an alliance-operated vessel now got hit on an Asia-Europe service,” noted Lars Jensen, the founder of container advisory Vespucci Maritime via LinkedIn.

“From a geopolitical perspective it is worth noting that this de facto pulls China closer into the conflict as well given OOCL’s ownership,” Jensen added.

Following the attack, maritime newspaper Tradewinds raised an intriguing prospect that Houthi rebels could be utilizing outdated data in targeting shipping assets. The vessel, Number 9, was chartered by the Israeli line Zim from October 2020 to December 2020. However, it has since been under a three-year fixture with Hong Kong-based Gold Star Line, starting in October 2021, and has been in service with Cosco-owned OOCL throughout this year.

Elsewhere, a Panama-flagged, Japan-owned, bulk carrier, AOM SOPHIE II, experienced heavy vibrations from an explosion nearby and was reportedly struck by an unidentified object in the southern Red Sea.

In another location, the AOM SOPHIE II, a bulk carrier flagged under Panama and owned by Japan, encountered intense vibrations due to an explosion in close proximity. The vessel was reportedly hit by an unidentified object in the southern Red Sea.

Will these threats lead ships to avoid the Red Sea and Suez Canal? Sea Trade Maritime News reports that “a growing number of vessels are diverting to avoid the region.”

Does it make sense to divert from the Red Sea? The U.S Naval Institute reports that “if a container ship is sailing between a southern Chinese port to Rotterdam, the voyage would be 10,000 nm using the Suez Canal; the voyage would be 13,500 nm around the Cape of Good Hope. Depending on ship’s speed, this difference can mean 8 to 12 days additional time along the southern route.”

The USNI noted, however, that “given a choice, select ships take the longer route either as a slow steaming strategy or to avoid Suez Canal fees. Tankers with U.S. crude exports usually avoid the Suez Canal by sailing around the Cape of Good Hope to Asia or sailing direct to European markets.

The attacks in the Red Sea come at a tough time for global shippers as profits are squeezed, albeit from all-time highs in 2021-2. As Fitch reports: “The easing of supply chain pressures that led to the near normalisation of container freight rates and lowering of profits in 2023 (after the peak of 2021-2022) has not yet fully flown through in annual earnings, and will result in further earnings weakness for container shipping companies in 2024.”

In August, Danish shipping giant A.P. Moller-Maersk reported a substantial decline in first-quarter net profit due to decreased shipping demand caused by inventory corrections in Western economies. It also warned that that trade volumes continue to contract.

For more on global shipping, check out this piece from these pages in June 2021

The Workhorse of Globalization: The Container Ship

“Buy Now.” If there’s a phrase that encapsulates our e-commerce, consumerist world of globalization, it’s that simple exhortation. Buy Now. With a tap of the screen, a click of a mouse, a flick of the wrist, that item tempting you with purchase on your laptop or phone can be yours within a week, a day, even a few hours.