Inside Trafigura's $1 Billion Staff Bonus

Global commodities traders had a record year in 2021. Robust demand for metals and fossil fuels jacked up prices. Now, companies like Trafigura are giving bumper bonuses to staff.

A story caught my eye last week in most of the major news outlets: global commodities trader Trafigura announced they will be delivering $1 billion in bonuses to staff and traders after a record-breaking year.

Most people might say: Trafi-who? (Emerging World readers the exception, of course!) Major commodities traders like Trafigura are generally not household names, even though their revenues rival major global brands like Microsoft or General Motors. They quietly move raw materials around the globe, filling the world’s sea lanes with ships laden with oil or copper or aluminum - fueling the global economy and filling their own bank accounts with billions of dollars.

Still, a $1 billion bonus pool? While considerably smaller than the bonus pool of, say, Goldman Sachs or other major investment banks, Trafigura’s staff is also much smaller. So, the payout can be considerably larger. To give an example, Vitol - another major global commodity trader and Trafigura rival - paid out nearly $3 billion to staff in buybacks this past summer - equivalent to about $7 million to each of the firm’s 400 partners.

It’s an astounding sum, but one that measures up to the astounding revenues and net profits of global commodities trading houses who rode the wave of an extraordinary demand recovery for metals and fossil fuels amid rising prices driven by supply chain dislocations and tightening supply.

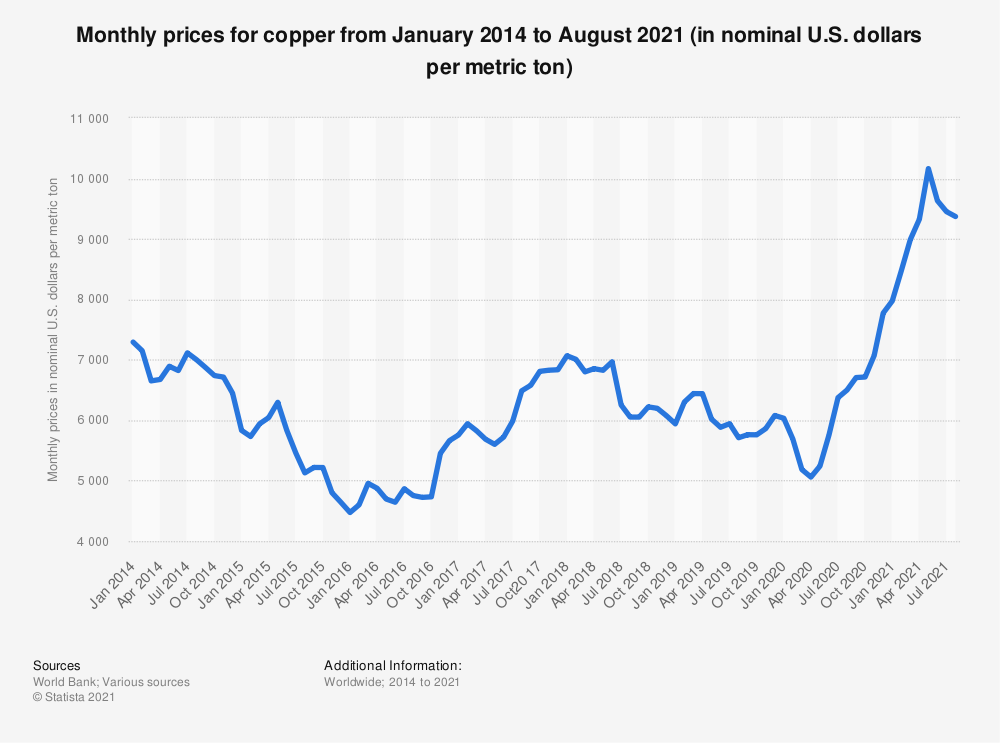

These two charts from Statista might help explain why Trafigura, a major copper and oil trader, had such a good year. This one below is a monthly copper price chart. From April 2020 to January 2021, the price more than doubled, before dipping slightly again.

That’s powerful wave to ride for any copper trader.

Then, there was oil. After plumbing new lows early in the pandemic, oil began a steady march upward. This chart shows historic Brent crude prices going back to 1976. Take a look at the bump from 2020 to 2021.

There’s a lot of profit in there for those who were actively trading.

In fiscal year 2021, according to Statista, Trafigura was top of the heap of commodities traders in revenues followed by Glencore. Both companies generated more revenue than J.P Morgan Chase. Trafigura even topped Microsoft.

Net profits are another story. It’s a high revenue, high cost business. On $231 billion in revenue, Trafigura netted just over $3 billion in profits.

Trafigura CEO Jeremy Weir noted that “underlying fragilities in global supply chains were laid bare” in 2021 amid the pandemic. Even as demand rebounded with lockdown easing, he said: “logistics and supply struggled to keep pace”. This contributed to rising prices of commodities across the board, providing a lucrative opportunity for Trafigura and its competitors.

Trafigura By the Numbers

$231.3 Billion - Trafigura’s revenue in the 12 months through September 2021

$67 Billion - Trafigura’s total credit line from banks (Note: commodities traders require massive credit lines to conduct business)

$3.1 Billion - Net profit in the 12 months through September 2021 (this is almost double the previous year’s net profit)

$1 Billion - The bonus pool to be shared by Trafigura staff after a record-breaking year

22.8 Million - The amount of metric tons of non-ferrous metals traded by Trafigura this year, including copper and aluminum

7 Million - The number of barrels of oil and petroleum products that Trafigura trades every day. This is equivalent to 6 in 100 barrels of oil consumed every day.

10% - The percentage stake bought by Trafigura in Arctic oil project Vostok Oil LLC from Russia’s state-owned Rosneft. Bloomberg reported that Trafigura secured a $7 billion loan from a Russian bank to finance the deal.

82% - Annual gains in a hedge fund owned by Trafigura

Sources: Wall Street Journal, Financial Times, Trafigura

The Secretive, Swashbuckling World of Commodities Traders

For more on the world of commodities traders, I’d recommend the book by Bloomberg reporters Javier Blas and Jack Farchy, the World for Sale. Back in March, I reviewed the book and offered some of my own tales on the oil trail, including chasing “the two amigos” - the late Venezuelan President Hugo Chavez and former Iranian President Mahmoud Ahmadinejad - in Riyadh. Check out the column below:

“I Will Make You a Billionaire”

And for more columns and the Emerging Markets Daily, hit this button below to subscribe at no cost.

“The New World Has a New Terrain” - Daniel Yergin

You might also find a recent Emerging World interview of interest. We sat down - well, Zoom’ed down - with Pulitzer Prize-winning energy and geopolitics expert and author Daniel Yergin back in June. In that interview, Yergin talked oil, the energy transition, his writing process, the US-China confrontation, and so much more. It remains one of our more popular articles on the site. You can see it here - “The New World Has a New Terrain.”

Booming Profits and Rising Inequality: A Tale of Two Pandemics

Of course, the rising profits at commodities producers -- and tech companies, and among many of the world’s wealthiest investors — was happening at a time when the poor were getting poorer, and more people in the rising global middle class fell back into poverty, exposing and accelerating global inequality. I’ve often felt that the pandemic accelerated many existing trends. Unfortunately, rising inequality was one of them. This report in the Sri Lanka Guardian lays out some of the inequalities.

This Emerging World column, based on excellent reporting in the Wall Street Journal, also lays out some of the damage wrought by the pandemic in developing countries.

And, finally, a recent column that lays out Why Petroleum Still Maters - and why bumper profits for commodities traders are likely to continue.

Growing the Caravan

Dear Emerging World subscribers and fellow travelers. Our humble caravan of fellow travelers is growing, thanks to you sharing Emerging World with others.

We still have plenty more room in the caravan and a vast journey ahead of us, so please share with your friends and colleagues who might like to join us for the ride.

We have some strong original content in the pipeline and some big plans for the new year - and, yes, we’ll keep doing the Emerging Markets Daily - a round-up of the top stories shaping emerging markets from global media.

Until next time, I send you my warm good wishes wherever in the world you are, and remember what the great Roman poet Ovid said:

“Fortune and love favor the brave.”

So, I wish you courage and love in the new year.

Afshin